Tompkins Financial Mid-Year Market Newsletter

A Market Update for Q2 from the Investment Committee team at Tompkins Financial Advisors.

Inflation measures that include more volatile expense items such as energy and food prices showed signs of moderating compared to the extraordinarily high level of inflation experienced during the previous year. The Feds preferred measure of “core” inflation, which excludes energy and food prices, remained extremely sticky as prices for homes, renting an apartment, automobiles and a number of key services such as insurance costs, continue to increase as the economy enters into the traditionally busy (& inflationary) summer travel and home-buying season.

Following the lifting of the US debt ceiling, the US Treasury was tasked with refilling the treasury general account (TGA). The TGA had been depleted in the months leading up to the debt ceiling vote as the federal government chose to step in and financially backstop deposits held at Silicon Valley Bank and eventually negotiated the sale of assets held at First Republic Bank (valued at roughly $233B) to J.P. Morgan, greenlighting the largest acquisition in the banking industry since 2008.

Immediately following Congress’ passing of the debt ceiling vote, Fed Chairman Jay Powell and the U.S. Federal Reserve paused their fight against inflation, deciding not to increase interest rates for the first time since March of 2022. In doing so, the US Treasury was able to refill some of their coffers by issuing debt at slightly lower rates than if the Federal Reserve had opted to continue hiking interest rates.

In response, both equity and fixed income markets initially rallied as markets interpreted the Feds decision to pause their rate hikes as a “pivot” towards enacting more accommodative monetary policies in the months ahead.

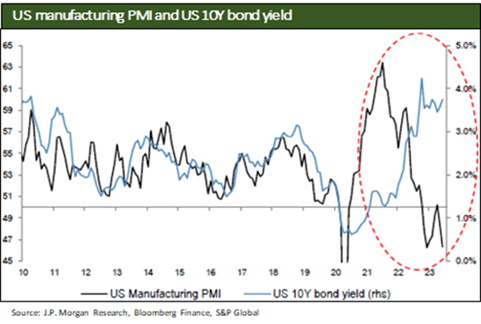

Subsequent to their initial rally, interest rates on longer-term bonds have begun approaching last years prior highs as core inflation remains well above acceptable levels of the federal reserve, which asymmetrically pressures the financial security of low and middle income consumers.

Equities, on the other hand, have remained resilient, as shares of the 5 largest companies in the S&P 500 continue to account for nearly the entire increase in market appreciation so far this year.

Whether based on expectations for a pivot from the Federal Reserve toward more dovish monetary policy or the interpretation that broad-based adoption of Artificial Intelligence will provide support for corporate profit margins in the years ahead, the bullish point of view has likely become a “show-me” story as investors search for a return to corporate profit growth or lower interest rates to support the markets current valuation.

Defining the "R" Word

The most common question(s) from clients over the last few months have been inquiries related to what some seasoned investors describe as the dreaded “R” word – Recession. Depending on your preferred lens for observation, you may see a different shade of grey depending on how you choose to define “recession”.

Recessions can be defined a variety of different ways depending on the context within any particular discussion.

When compared to recent years of a highly stimulated and growing economy, we tend to view the state of the economy as undergoing a welcomed “Reset” toward more normalized levels of economic growth.

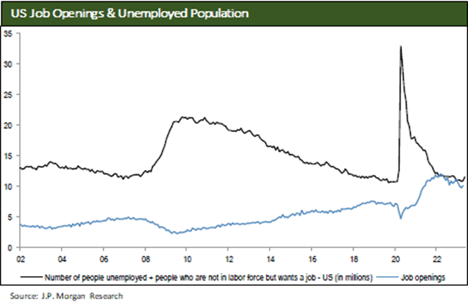

On Main Street, some may point to the difficulties of finding and retaining employees being a result of the large number of job openings that employees have to choose from. Generally speaking, having choices among employment opportunities would be thought of as a foundation of a healthy economy and supportive of a consumer’s ability to do what they do best, consume.

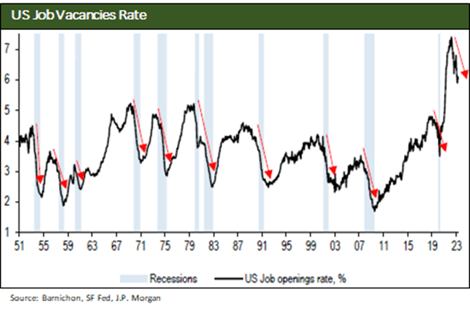

If you’re out to dinner on West Seneca Street, you could be reminded that the number of job openings tends to peak and move lower just prior to a recession.

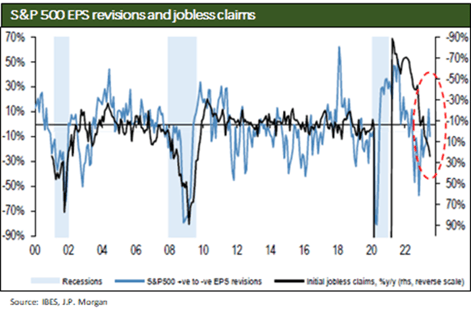

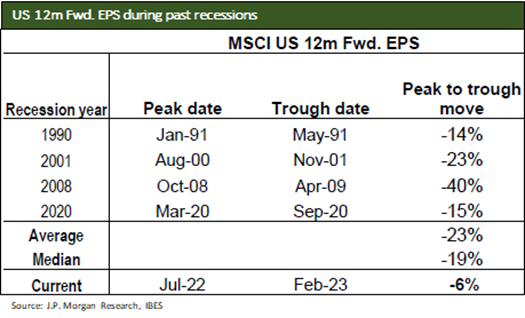

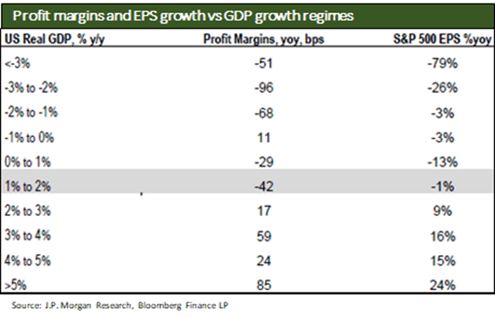

On Park Ave, someone else might mention that negative earnings revisions and increasing initial jobless claims have historically coincided with recessionary periods.

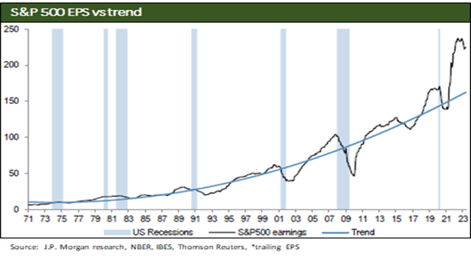

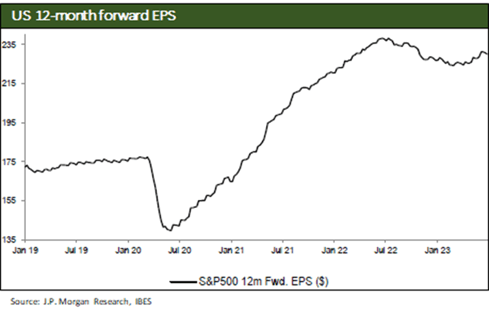

While any particular datapoint could be supportive for either the bullish or bearish side of the debate, we find it important to zoom out to help gain perspective regarding todays current starting point. Over the last 50 years corporate profits have grown tremendously, in support of one the strongest and longest lasting periods of economic expansion in modern history.

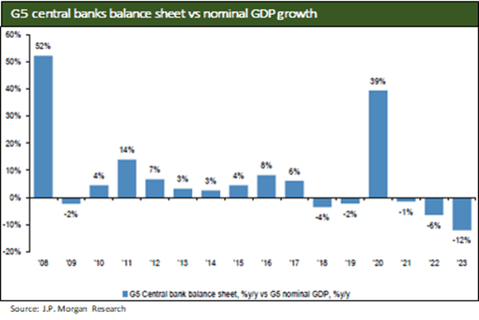

A key component of this modern era following the Financial Crisis/Great Recession of 2008, was the pivotal role that expansionary monetary and fiscal policies from governments across the world played in supporting and stimulating a large portion of this subsequent economic expansion.

With much of this period having benefitted from benign levels of inflation and record low interest rates, this more recent period of elevated inflation and rising interest rates marks an important inflection point of increasing borrowing costs for consumers and corporations alike.

Whether the example is a mortgage for the US Consumer, or refinancing a loan as a commercial borrower, or Gov’t agencies such as the US Treasury needing to finance their growing number of expenses; As lower cost loans that were made during the prior era of persistently low interest rates begin to mature over the coming years, the cost of (re)financing at these currently elevated interest rates will likely become a noticeably larger expense for corporations and consumers. This shift could eventually constrain the amount of discretionary consumer spending within US households and eventually become a larger burden on corporate profit margins.

Although the possibility of rising interest expenses remains an important risk on the horizon that we’ll continue to monitor; we believe that with unemployment remaining near historic lows and inflation continuing to show signs of moderating, the market may be embarking on a different interpretation of the “R” word – simply a “Reset” toward more normalized levels following the recent period of unprecedented economic and earnings growth.

Defining the “R” word makes for various characteristics and nuanced indicators that help identify Recessionary periods, not to mention that recessions are always “defined” by the US Bureau of Economic Research after they’ve already occurred. When compared with previous recessions, this current period may likely be remembered as something different.

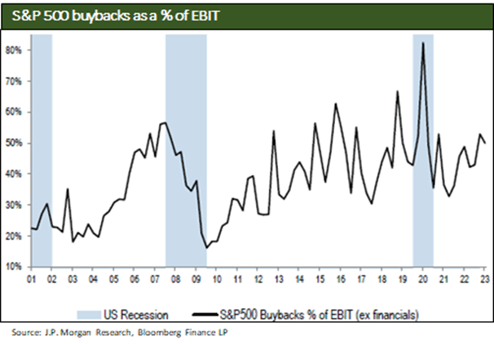

When coming so closely on the heels of the strongest period of economic growth on record, we’re comfortable being reminded that “Reset periods” of this nature tend to provide welcomed opportunities for investing incremental capital, often at attractive valuations. Many times seeing corporations using periods of moderating profit growth as an opportunity to repurchase stock which helps to increase corporate earnings, when measured on a per-share basis, during periods of market volatility.

Market Update provided by TFA Investment Committee. If you have any questions, please contact your wealth advisor.